Overview

A cornerstone of the UAE CT Law, Article 34, relies on the Arm’s Length Principle (ALP), a fundamental concept in Transfer Pricing (TP). It ensures that transactions between Related Parties 1and Connected Persons 2 are conducted under the same terms and pricing as a comparable transaction between two unrelated parties. This encompasses goods, services, financial transactions, and intangibles.

Want to know who comes under the purview of Related parties and Connected persons under the CT law? We have covered it for you,

Related Party – https://bcl.ae/related-parties-uae-transfer-pricing/

Connected Persons – https://bcl.ae/corporate-tax-law-uae/

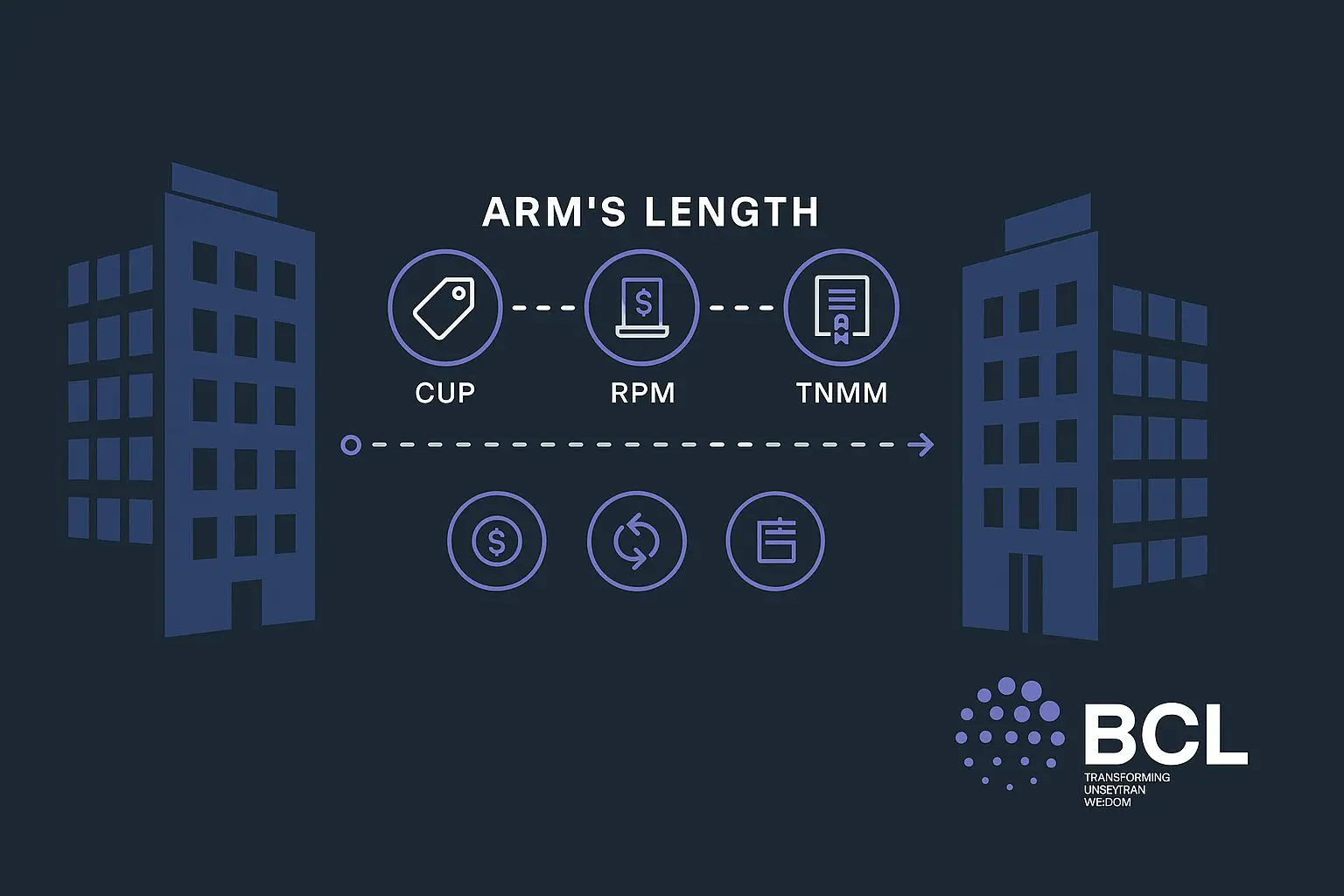

Transfer Pricing Methods Under UAE TP Rules

To ensure compliance with the Arm’s Length Principle (ALP) under Article 34 of the UAE CT Law, the following internationally recognized Transfer Pricing methods are applied to determine fair pricing in related-party transactions. <<Know more about the methods used to benchmark transactions made by the company with its related parties and connected persons https://bcl.ae/transfer-pricing-methods-uae/>>

- Comparable Uncontrolled Price (CUP) Method – Compares the price of a controlled transaction with that of a similar transaction between independent parties. It is preferred for commodities, financial transactions, and licensing agreements but requires strict comparability. << https://bcl.ae/comparable-uncontrolled-price-method/>>

- Resale Price Method (RPM) – Determines the transfer price by deducting an appropriate gross margin from the resale price. This method is commonly used for distributors and resellers who purchase goods from related parties and sell them without modification.

- Cost-Plus Method (CPM) – Establishes the transfer price by adding a profit markup to the supplier’s costs. Suitable for manufacturing, contract R&D, and service transactions where a clear cost structure exists.

- Transactional Net Margin Method (TNMM) – Evaluates the net profit margin of a controlled transaction and compares it with independent companies. It is widely applied in service arrangements, contract manufacturing, and distribution models. << https://bcl.ae/tnmm-in-uae-transfer-pricing/>>

- Profit Split Method (PSM) – Used when related parties make unique contributions to a transaction. It allocates combined profits based on relative value and is relevant for joint ventures, intangible-heavy transactions, and high-value services.

Alternative Methods

If none of the five standard methods can be reliably applied, businesses may opt for alternative approaches, provided they can justify their selection with economic and commercial reasoning. One such alternative is the Discounted Cash Flow (DCF) method, which assesses the present value of future cash flows to determine pricing for transactions involving long-term contracts, real estate developments, or complex financing arrangements. However, the use of alternative methods requires strong documentation to demonstrate their appropriateness in establishing arm’s length pricing.

Each TP method must be carefully selected based on the nature of the transaction, the availability of comparables, and regulatory expectations. In the UAE, businesses must ensure that the chosen method aligns with Article 34 of the UAE CT Law and provides a robust justification in their TP documentation.

Unique Aspects of UAE TP Rules

Some unique aspects of the UAE TP rules are outlined below:

- Interquartile Range (IQR) Approach – The UAE TP rules recommend using the IQR rather than the full range suggested by the OECD. However, how this will be applied in practice remains to be seen, particularly in cases where transaction values fall slightly above or below the IQR (e.g., deviations may be automatically adjusted to the median).

- Business Restructuring Considerations – These are aligned with the OECD TP Guidelines; however, they also cover domestic restructurings for UAE TP purposes.

- Benchmarking Analysis – Extreme benchmarking results, such as significant losses or unusually high profits, require further analysis to determine their underlying cause. Exclusion of such results is only warranted if a comparability defect has been discovered—not merely because the results differ substantially from those of other comparables.

- Comparable Data Sources – The FTA does not prefer a particular commercial database when searching for comparables, as long as the source is reliable and the geographical order for applying the comparables is followed (i.e., local, regional (Middle East), then other regions).

- Gross vs. Arm’s Length Transaction Value – There is a distinction between gross transaction value and arm’s length transaction value in the Disclosure Form. Taxpayers need to report both values independently, and the difference between them is automatically reported as an adjustment, as opposed to reporting the net impact.

- Downward Adjustments – The FTA maintains a clear position on downward adjustments: any adjustments to non-arm’s length transactions that result in reduced taxable income (or increased losses) must be reported to and approved by the FTA prior to submission. The approval process is yet to be announced.

Double Taxation and Corresponding Adjustments

Assuming a double-tax treaty is in place and the application of the ALP leads to a TP adjustment by a foreign competent authority, the Taxable Person may request the FTA to apply a corresponding adjustment to their taxable income in accordance with the relevant double taxation agreement. The FTA will assess the foreign tax authority’s position and, if deemed appropriate, may implement the corresponding adjustment.

Compliance and Documentation Requirements

- The UAE CT Law mandates that all intercompany transactions, whether cross-border, domestic, or involving free zone entities, must comply with the ALP.

- Even exempt entities and those electing for Small Business Relief (SBR) must adhere to the ALP for their intercompany transactions where applicable, ensuring that transactions with related parties reflect arm’s length terms.

- Taxable persons are required to maintain contemporaneous documentation of their controlled transactions to demonstrate compliance with TP regulations.

- Businesses that exceed the thresholds outlined in the Transfer Pricing Documentation section (i.e., revenues of AED 200 million for the Local File and part of a MNE group with consolidated revenues of at least AED 3.15 billion for the Master File) will be required to maintain comprehensive TP documentation, including a Master File and Local File.

Conclusion

In summary, Article 34 of the UAE CT Law upholds the Arm’s Length Principle (ALP), ensuring fair pricing for transactions between Related Parties and Connected Persons. The UAE Transfer Pricing (TP) rules outline key methods to determine arm’s length pricing, requiring businesses to maintain proper documentation, benchmarking, and compliance. With specific reporting requirements, adjustments, and regulatory expectations, businesses must stay proactive in aligning their intercompany transactions with FTA guidelines to mitigate risks and ensure compliance.

How BCL Globiz Helps?

BCL Globiz provides comprehensive Transfer Pricing (TP) support to ensure businesses comply with UAE CT Law and Article 34. Our experts assist in determining the appropriate TP method, conducting benchmarking studies, and preparing robust documentation, including Master Files and Local Files. We help businesses navigate related party transactions, ensure accurate disclosures, and manage compliance risks efficiently. With a deep understanding of FTA requirements, we offer tailored advisory services, TP documentation support, and strategic insights to help businesses align with Arm’s Length Principle (ALP) while optimizing their tax positions.

For further information, reach out to our experts at rakesh@bclglobiz.com.