Corporate Tax Service

Key Stats

Specialised Services

1

+

Industries Served

1

+

Years Of Expereince

1

+

Experts Team Globally

1

+

UAE

UAE

Tax Management is considered as the toughest responsibility of an organization as it demands intricate detailing and effective structuring. However, proper tax history helps prevent financial loss and reduces liability while enhancing the goodwill of the organization. BCL’s tax service suite provides a comprehensive approach to the overall tax structure of your organization.

Overview:

The United Arab Emirates, which houses significant corporate gateway of Dubai, will have one of the lowest corporate tax rates in the world. This proposal stems from the UAE’s intention to comply with international tax rules, reflecting similar efforts in other Gulf nations, while reducing regulatory burdens for UAE firms and protecting small businesses and start-ups.

Effective Date:

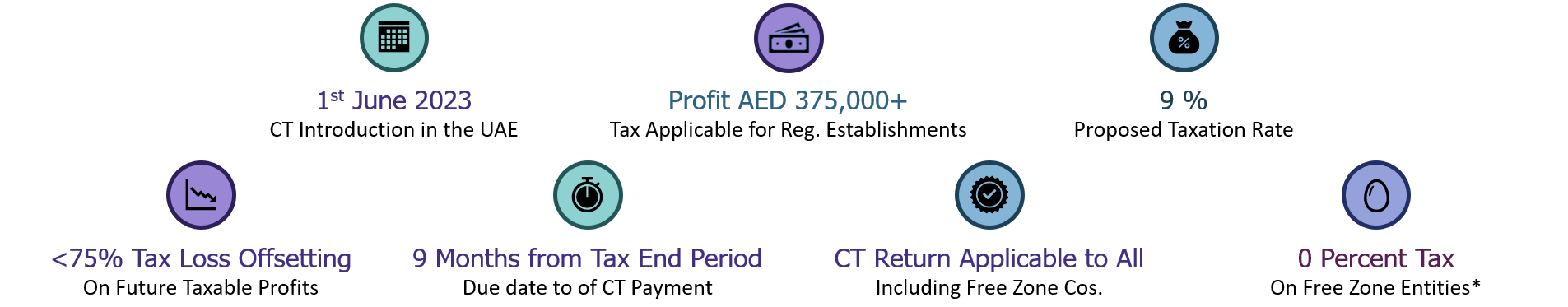

The UAE has decided to introduce Corporate Income Tax (CIT) on business profits in the country. It will be effective for financial years starting on or after June 2023.

Corporate Tax Rates in UAE :

The following are the proposed corporate tax rates:

Key Takeaways from UAE Corporate Law:

Proper structuring of tax creates a regulated framework for all your tax payments and trading arrangements. It helps in reducing a range of direct and indirect tax your organization is required to pay. A perfect tax plan aligns with its corporate strategy or business framework, and includes identification of tax risks.

Filing proper tax returns on time with adherence to both national and international tax governance bodies (FTA, CSR, etc.) lets you off the penalties and legal proceedings. A business subject to CT will need to register with the FTA and obtain a Tax Registration Number within the prescribed period. The Tax return and the CT payment must be made within nine (9) months from the end of the relevant Tax Period.

Corporate Tax Filing Services:

At BCL, we understand the intricacies of the corporate tax landscape. Our expert team of tax advisors goes beyond simple compliance, offering a comprehensive suite of corporate tax services designed to optimize your financial health & navigate today’s complex tax environment.

Here’s how BCL Globiz empower your business:

Strategic Tax Planning:

Seamless Corporate Tax Registration Services:

Flawless Corporate Tax Filing Services:

Unwavering Corporate Tax Compliance Services:

But our expertise extends beyond just corporate tax compliance:

Expert Documentation Guidance:

Rigorous Submission Scrutiny:

Choosing BCL’s corporate tax advisory services is more than just outsourcing compliance. It’s a strategic investment in your long-term success. We become your trusted partners, working alongside you to unlock tax efficiency, minimize risks, and optimize your financial performance.Contact us today for a free consultation and discover how our comprehensive corporate tax advisory services can propel your business towards a brighter financial future.

Corporate Tax will be levied at a headline rate of 9% on Taxable Income exceeding AED 375,000. Taxable Income below this threshold will be subject to a 0% rate of Corporate Tax.

We provide highly professional boaUAE Corporate Tax applies to juridical persons incorporated in the UAE and to foreign juridical persons that are effectively managed and controlled in the UAE. A foreign juridical person that operates in the UAE through a Permanent Establishment or that has a taxable nexus in the UAE would also be subject to Corporate Tax.

Natural persons will be subject to Corporate Tax only if they are engaged in a Business or Business Activity in the UAE, either directly or through an Unincorporated Partnership or sole proprietorship. Cabinet Decision No. 49 of 2023 specifies further information on what would bring a natural person within the scope of UAE Corporate Tax.

Therefore it is very clear from the above that every business will be covered by corporate tax except for the specific exemption provided by the cabinet.okkeeping services. We ensure that proper chart of accounts are created before the start of accounting project and ensure that management gets the profit numbers at the tip of a button. Our USP is timely completion of bookkeeping which is as accepted internationally as we follow IFRS & GAAP.

Yes, Free Zones that are a qualifying free zone will get 0% corporate tax rate if the activities by a businessmen is categorized under qualifying business activity as per Ministerial Decision number 265 of 2023. It also covers few designated zone activities that may be taxed at 0% and a designated zone is same as Federal Decree-Law No. (8) of 2017 on Value Added Tax

When an individual invests in real estate within their financial means, it stays tax-free. Meaning investment income is not subject to corporate tax.

As per the Ministerial Decision No. 82/2023, all Taxable Persons deriving revenue exceeding AED50,000,000 (fifty million) during the relevant tax period, and all Qualifying Free Zone Person(s) (regardless of its Revenue) are required to prepare and maintain audited financial statements. In the case of all other Taxable Persons, the Federal Tax Authority can ask for financial statements from any Taxable Person.

Corporate Tax Services in Business Bay | Corporate Tax Services in Jumeirah Lake Towers (JLT) | Corporate Tax Services in Dubai Silicon Oasis (DSO) | Corporate Tax Services in Sheikh Zayed Road | Corporate Tax Services in Deira | Corporate Tax Services in Al Quoz | Corporate Tax Services in Dubai International Financial Centre (DIFC) | Corporate Tax Services in Dubai Internet City (DIC) | Corporate Tax Services in Dubai Media City (DMC) | Corporate Tax Services in Dubai Healthcare City (DHCC) | Corporate Tax Services in Dubai Design District (d3)

Need Help?

We're Here To Assist You

Something isn’t Clear?

Feel free to contact us, and we will be more than happy to answer all of your questions.