UAE Transfer Pricing Disclosure Form Overview

The UAE Federal Decree-Law No. 47 of 2022, which governs the taxation of corporations and businesses, mandates that taxpayers submit a Transfer Pricing (TP) Disclosure Form along with their Corporate Tax Return. This disclosure form requires information on arrangements with related parties, as stipulated in Article 55(1).

The Federal Tax Authority (FTA) has issued the TP Guide, outlining the key components of the TP disclosure form, including the nature and value of controlled transactions, details of related parties, and TP methods. The deadline for submitting this form aligns with the Corporate Tax Return filing deadline, which is within nine months from the end of the tax period (due on 31 December 2024).

With the recent launch of the EmaraTax Portal, taxpayers can now conveniently update and submit the Transfer Pricing Disclosure Form alongside their Corporate Tax Return. This development brings greater clarity and certainty to taxpayers regarding the information and documents required for transfer pricing compliance. This article includes the following:

Key Sections of the Disclosure Form:

The disclosure form consists of three main sections as outlined below:

- Related party transaction schedule

- Connected person schedule

- Adjustments to gains and losses w.r.t transactions with related parties

-

Related Party Transaction Schedule:

This schedule provides comprehensive details of transactions with related entities, including the names of the parties involved, their countries, the types of transactions, the gross value, the transfer pricing method applied, the arm’s length value, and any applicable tax adjustments.[1] The related party transaction schedule is structured into three main parts:

- Gross Income received from related parties:

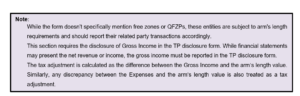

The UAE TP Disclosure Form mandates that the full gross value of related party transactions be reported without any adjustments. This requires businesses to report total transaction amounts without deducting discounts or rebates. All income or revenue transactions, including those that impact the profit and loss statement or balance sheet (such as expense recoveries), must be recorded in the ‘Gross Income Received from Related Parties’ section.

For instance, if goods worth AED 1,200,000 are sold to a related party with a discount of AED 200,000, the total sales should be reported as AED 1,200,000, with the discount disclosed separately.

- Expenditure Paid to Related Parties:

Expenditure transactions, along with those that affect the profit and loss statement or balance sheet (such as reimbursement of expenses), must be recorded in the ‘Expenditure Paid to Related Parties’ tab.

For both income and expenditure transactions, the following details must be provided: a) Name of the Related Party, b) Tax Residence c) Gross Income (in AED) /Expenditure as the case may be d) Arm’s length value (in AED) e) Transaction type: ⮚ Goods

⮚ Services

⮚ Intellectual Property (IP)

⮚ Interest

⮚ Assets

⮚ Liabilities

⮚ Others*

f) Corporate Tax TRN/TIN (if available) g) Transfer Pricing method: * ● CUP method

● RPM method

● CPM method

● PSM method

● TNMM method

* The ‘Others’ category in the Related Party schedule of the UAE TP Disclosure Form is designed for transactions that do not clearly fall into the predefined categories of goods, services, IP, interest, assets, or liabilities. This can include specialized or complex transactions such as cost-sharing arrangements, guarantees, hedging transactions, reimbursements, or any other related party dealings that don’t fit within the standard categories.

* The UAE TP Disclosure Form provides the option to select from five OECD standard transfer pricing methods. Notably, there’s no option for an ‘Other Method’ at this time. We may expect further clarification from the FTA, as certain transactions could find the ‘Other Method’ to be the most suitable approach.

-

- Summary table:

The Summary Table tab provides an overview of the related party transactions recorded in the ‘Gross Income Received from Related Parties’ and ‘Expenditure Paid to Related Parties’ tabs. It aggregates the total value of transactions/ arrangements with related parties across the following categories:

| Transactions | Income (in AED) | Expenses (in AED) |

| Sales or purchases of goods | ||

| Services rendered or received | ||

| Royalty, license fees, and other receipt/payments in relation to intellectual properties | ||

| Interest income and expenses | ||

| Assets | ||

| Liabilities | ||

| Other transactions not falling under the items above | ||

| Aggregate |

In addition to the above, the total transfer pricing adjustments from the other two tabs are reported as a consolidated figure under ‘Total Transfer Pricing Adjustments (in AED).

2. Connected Person Schedule:

The form includes a dedicated connected person schedule, where all payments made to connected person—such as directors, officers, and owners—must be reported. This schedule should specify the names, relationships, nature of payments, and amounts involved. It’s crucial to ensure that these payments are business-related and reflect market value to prevent any tax disallowance. Additionally, it is essential to keep the Connected Persons Schedule updated regarding all transactions conducted between the taxpayer and connected persons.

In the Connected Persons Schedule, it is essential to accurately value and report non-monetary benefits too. To do this, one should indicate the market value of the benefit in AED and provide a brief explanation of the nature of the non-monetary benefit along with the valuation method used in the ‘Description of payment or benefit’ section. This ensures transparency and compliance with the relevant regulations.

| The details to be updated include: |

| a) Name of the Connected Person, |

| b) Payment or Benefit:

i. Payment ii. Benefit |

| c) Corporate Tax TRN/TIN (if available) |

| d) Description |

| e) Value of the payment or benefit provided to the Connected person (in AED) |

| f) Market value of the service or benefit provided by the connected person (in AED) |

3. Adjustments to gains and losses w.r.t. opening balances:

The ‘Tax adjustment’ field in the UAE Transfer Pricing disclosure form reflects the discrepancy between the actual transaction value and the arm’s length value, indicating the necessary adjustments to taxable income to align with market pricing. This adjustment is particularly relevant for gains and losses associated with assets and liabilities obtained from related parties at non-arm’s length prices. Under the Federal Decree Law’s transitional provisions, opening balances for the first tax year must be restated according to the arm’s length standard, allowing tax authorities to assess the potential implications of transfer pricing on the entity’s tax liability.

Documents Required

In addition to the updates required for the Related Party Transaction Schedule and the Connected Persons Schedule, the TP disclosure form includes a section for uploading various documents. The ‘Additional Attachments’ section of the TP Disclosure Form is designated for these supplementary documents.

| The following documents need to be uploaded: |

| 1) Financial statements |

| 2) Local File |

| 3) Master file |

| 4) Confirmation of ownership and the right to utilize the Qualifying Intellectual Property—such as patents, copyrighted software, or similar rights |

| 5) A record of qualifying expenditures and total expenses incurred |

| 6) A record of total income derived from qualifying expenditures and income generated from qualifying intellectual property |

| 7) Documentation to verify the market value of the qualifying immovable property at the beginning of the first tax period. |

| 8) Documentation to verify the market value of financial assets/liabilities at the beginning of the first tax period |

| 9) Tax residency certificate from the relevant foreign jurisdiction |

Key Takeaways

- There is no threshold or de minimize limit concerning transactions with related parties and connected persons for filing the TP disclosure form. The Federal Decree Law, along with the TP Guide from the FTA, stipulates that all related party transactions must comply with the arm’s length standard, which is also reflected in the TP Disclosure Form. While thresholds for the local and master files have been established, taxpayers must ensure that all related party transactions are conducted on an arm’s length basis and be prepared to substantiate this, including specifying the appropriate transfer pricing method in the TP Disclosure Form.

- There is no specific penalty for non-compliance of TP disclosure form. The penalty for non-compliance with the TP disclosure form will be similar to the penalty for CT return non-compliance. i.e. AED 500 per month for the first 12 months. AED 1,000 per month after 12 months.

- The transfer pricing method does not include the “Other Transfer Pricing Method,” as outlined in Article 34(4) of the Federal Decree Law. Therefore, using this method should be approached with caution, and entities should evaluate whether an alternative secondary method is more appropriate for declaration in the TP Disclosure Form, along with the justification provided in the local file.

- According to the TP Guide from the FTA, the receivables balance must be realized within the arm’s length credit period (as noted in paragraph 7.8.2 of the TP Guide). Consequently, tax authorities may consider the receivable balance as a separate transaction if it exceeds the arm’s length credit terms. To mitigate penalties, taxpayers should consider treating the receivable balance as a separate transaction, using the same transfer pricing method applied to the base transaction.

- Transactions in foreign currencies need to be carefully converted into AED at the correct exchange rate for disclosure. Use the exchange rate applicable on the transaction date or an average rate for the period, ensuring consistency in the approach.

- Entities opting for small business relief are not required to maintain TP documentation for related party transactions, but they still need to adhere to the arm’s length standard. These entities may be required to file the TP disclosure, as there is currently no specific exemption available.

- Payment-related transactions with connected persons fall under the transfer pricing regulations as per the Federal Decree Law. The TP Disclosure Form only lists payments or expenses in this context. However, the Connected Persons Schedule does not require disclosure of the transfer pricing method used for payments or expenses involving connected persons.

- In cases where the parent entity and subsidiary entities choose to form a Tax Group, transfer pricing regulations do not apply to transactions between the entities within the Tax Group, as indicated in the TP Disclosure Form.

- The absence of any mention of Tax Groups or transactions between entities within a Tax Group in the form implies that the TP Disclosure Form may not apply to these exempted transactions.

- The Federal Decree Law exempts tax-neutral transactions from the scope of transfer pricing documentation. However, there is no similar exemption for the TP Disclosure Form, indicating that these transactions may still need to be reported within the form.

- Both the Federal Decree Law and the UAE TP Guide allow for the use of a combination of transfer pricing methods to support the arm’s length nature of related party transactions. However, the TP Disclosure Form does not provide a section for submitting a combination of transfer pricing methods. Taxpayers may want to select one primary method and disclose it in the TP Disclosure Form.

- In the Gross Income and Expenditure tabs, only certain transaction categories, such as goods, services, intellectual property, and assets & liabilities, are included. Other transactions, such as guarantees, reimbursement or recovery of expenses, and free-of-cost assets, should be reported under the category “Others.”

- When taxpayers are considering Suo-moto adjustments for transactions with related parties or connected persons, a question may arise regarding whether to use the 25th percentile, 75th percentile, or median of the dataset as the arm’s length price. The Federal Decree Law specifies that related party transactions not falling within the arm’s length range must be adjusted (Article 34 (8)). Therefore, it may be prudent to consider using the two ends of the range as applicable. However, on a conservative basis, selecting the median as the arm’s length price and adjusting related party transactions accordingly may be advisable.

- The Federal Decree Law mandates that local and master files must be maintained when threshold limits are met. Additionally, these documents must be provided to tax authorities within 30 days upon request. The UAE TP Guide states that the local and master files must be maintained contemporaneously, meaning they should be ready by the time the Tax Return or TP Disclosure Form is filed (para 6.6.2). Some taxpayers and stakeholders have expressed concerns regarding the requirement to upload TP documents alongside the Tax Return, given that these documents must be provided within 30 days of a request from tax authorities. However, since the documentation must be maintained contemporaneously as per the Federal Decree Law and UAE TP Guide, it can be inferred that the TP Disclosure Form includes a feature for filing these documents to demonstrate compliance with this requirement.

Glossary

| Sl.no | Term/ acronym | Full form |

| 1 | AED | United Arab Emirates Dirham |

| 2 | CPM | Cost-Plus Method |

| 3 | CT | Corporate Tax |

| 4 | CUP | Comparable Uncontrolled Method. |

| 5 | EmaraTax | An online platform, through which you can access the digital services for registration, filing returns, paying taxes and seeking refunds in the UAE. |

| 6 | FAQ | Frequently Asked Questions |

| 7 | FTA | Federal Tax Authority |

| 8 | IP | Intellectual Property |

| 9 | OECD | Organization for Economic Co-operation and Development |

| 10 | PSM | Profit Split Method |

| 11 | RPM | Resale Price Method |

| 12 | TNMM | Transactional Net Margin Method |

| 13 | UAE | United Arab Emirates |

| 14 | w.r.t | With respect to |

Feel free to reach out to us at rakesh@bclglobiz.com if you have any queries relating to Transfer pricing & Corporate tax return filing.

Also Read

- Transfer Pricing Updates in UAE

- Economic Substance Regulation in UAE

- Corporate Tax Guide UAE

- Penalties Under UAE Corporate Tax Law

- Ultimate Beneficial Ownership UAE Guide