How to Start Interior Design Business in Dubai – Key Steps

Dubai is one of the most luxurious destinations, offering a booming market for interior designers. The city constantly witnesses the development of luxury apartments, villas, and commercial buildings, creating a high demand for interior design. With a strong preference for premium and customized interiors, both residents and businesses seek unique and sophisticated designs. Additionally, the rise of hotels, resorts, and restaurants has further fuelled the need for innovative interior concepts to attract tourists and enhance their experiences.

In our blog today, we delve into the nitty-gritties of establishing an interior design business from a legal and incorporation perspective.

-

Identify the business structure:

Choosing the ownership structure and defining the market the business serves help a company determine the right business structure. The following can be considered:

-

Mainland entities:

If the business deals with local business entities or individuals, it is suggested to establish the business on the mainland.

The important feature of mainland business affecting the business structure are:

- Mainland businesses have no restrictions on the scope of their operations.

- Mainland businesses previously were restricted to having foreign investment more than 49%, while the local emirate must own at least 51%. However, the UAE government now allows 100% foreign ownership for a few specified sectors.

-

Free Zones entities:

If the business caters to customers outside the UAE or entities established in a free zone, then this can be considered.

The key features and restrictions of a freezone business that impact the business structure are:

- They can trade freely within their free zone and internationally, without any restriction. However, they cannot cater to the users directly.

- Offers complete ownership of the business.

- If the business activity falls under “Interior Design Engineering Services,” then Freezone may not offer a trade license for such a business as these are regulated activities. Therefore, the business must establish its entity on the mainland.

-

Obtaining licenses from the municipality:

Interior designers can specialize in various fields based on the type of spaces they design and the services they offer.

a. If the activities fall under Interior Design Engineering Services:

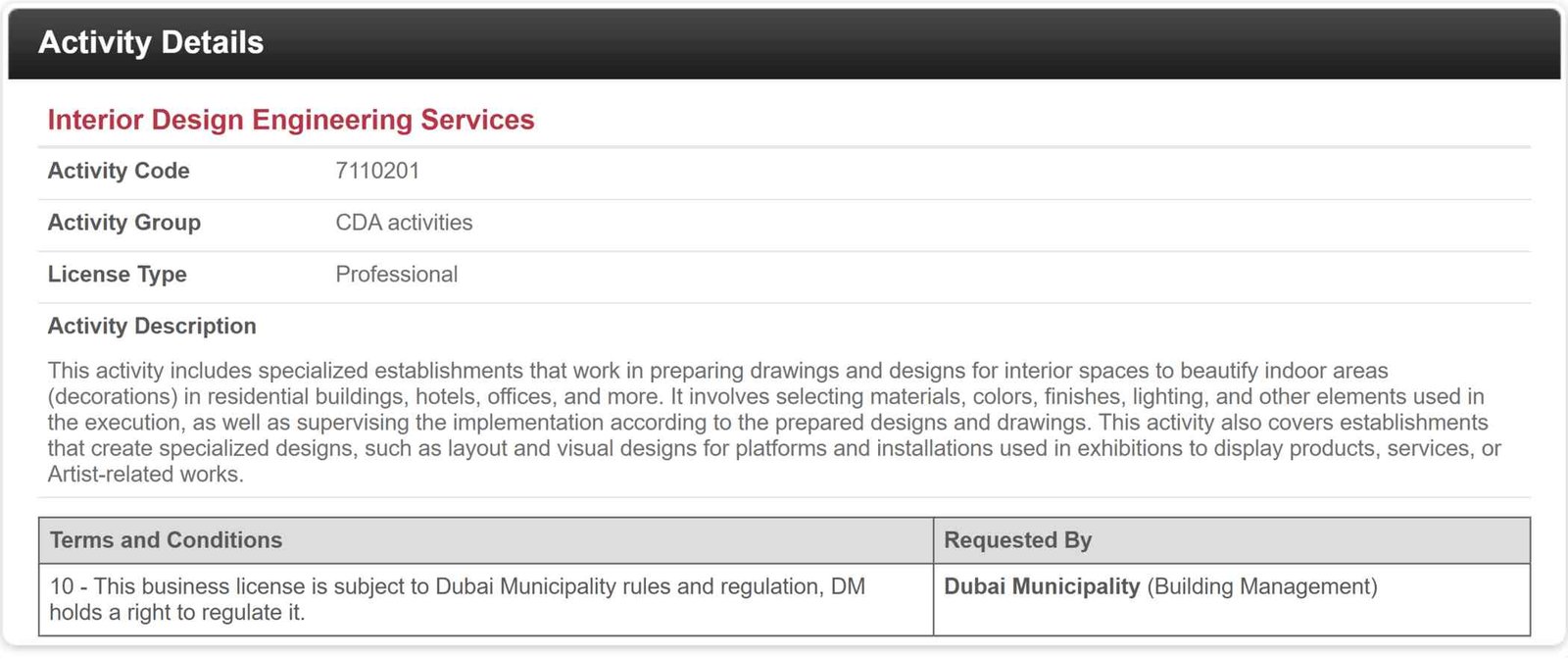

Figure-1: Image of the business activity code for interior design engineering services

If the primary business activity falls under “Interior Design Engineering Services” (Fig 1), which requires the selection of the business activity code “7110201,” then additional approval from Dubai Economic Department (DED) as it is a regulated activity. This license is a legal permit required to operate an interior design business in Dubai.

b. If the activities fall under design services:

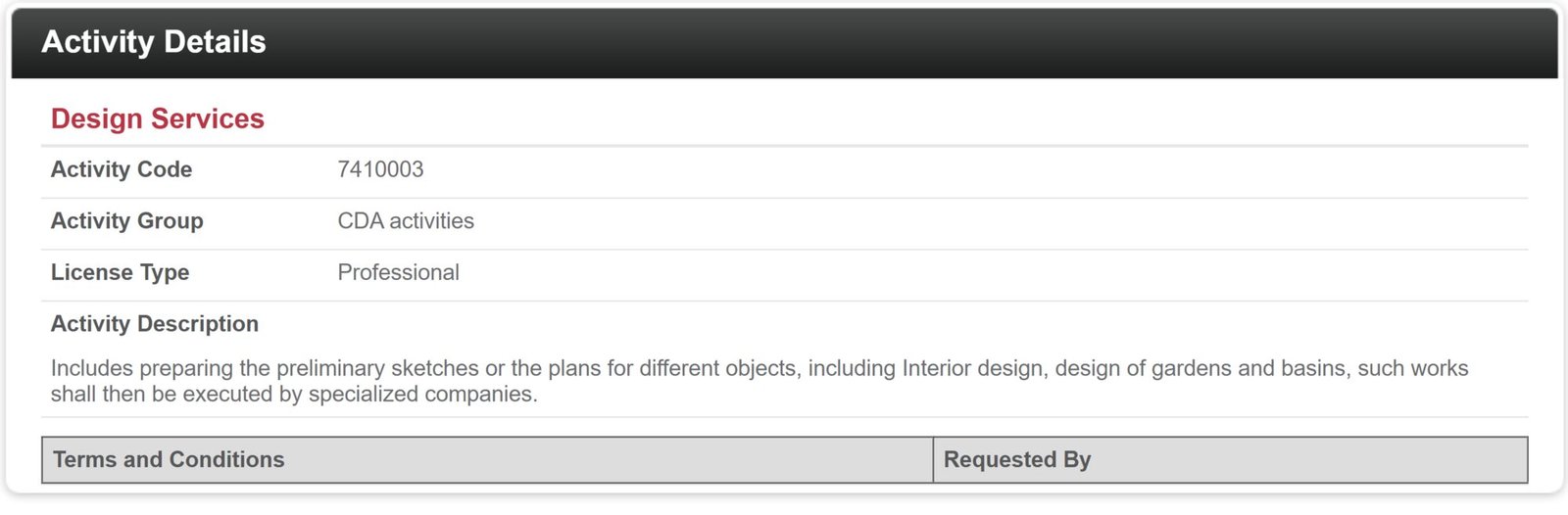

Figure-2: Image of the business activity code for Design services

On the other hand, if the business activity falls under “Design Services,” for which the code “7410003” is to be selected, then additional approval is not required.

Choosing the right business structure is crucial for your interior design firm. Learn about the different types of company registration in Dubai to make an informed decision.

-

Setting up the business:

The activities required to set up a business depend on the chosen business structure—Mainland or Free Zone. For more information on setting up mainland entities, refer to our blog. The common points are listed below.

- Choose three unique trade names for your business. If you choose to establish your business on the mainland, ensure that it complies with the Department of Economic Development (DED) guidelines.

- Mainland companies must have a physical office. A tenancy/lease contract is required, which must be registered with Ejari (Dubai’s tenancy registration system).

- For LLCs, the MOA outlines the company’s structure, activities, and share distribution. You must select other terms that align with best practices in the UAE.

- Certain documents, such as Ejari, trade name certificates, etc., must be submitted to DED to obtain a business license, especially for mainland entities.

- Documentation such as shareholders’ passports with at least six months of validity, a digital copy of a clear passport-size photo of all shareholders, visa copies, and other necessary documents may be required by some free zones.

- The Establishment Card or Immigration Card is required to apply for a visa for the shareholder in mainland entities.

- The medical test and biometrics for the Emirates ID must be completed along with visa stamping.

Deciding between a mainland or free zone setup? Understand the differences in our guide on setting up a business in UAE: Mainland vs. Free Zone.

-

Setting up bank accounts, VAT/Corporate Tax Registrations and Accounting:

We, BCL Globiz, help businesses at every step, from setting up the company and opening a bank account to obtaining VAT and corporate tax registration and maintaining financial records.

Businesses can also utilize profit and loss accounts on a project-wise or department-wise basis to make informed future decisions.

Reach out to our experts at punith@bclglobiz.com.

Also check out Why new business owners should also be aware of tax implications. Read our UAE Corporate Tax Guide to stay compliant.