Understanding UAE Transfer Pricing Related Parties

WHO ARE RELATED PARTIES?

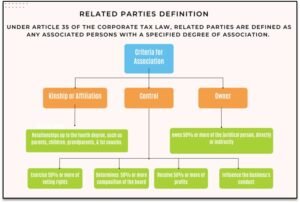

A related party refers to an individual or entity with an established relationship with a business subject to the UAE Corporate Tax (CT) framework. This relationship may arise through ownership, control, or kinship (for individuals).

To ensure compliance, taxpayers must identify their related parties as defined in Article 35 of the UAE CT Law, with additional guidance provided in the UAE Transfer Pricing (TP) Guidelines. It is crucial to recognize that the definition of related parties under UAE TP regulations differs from the criteria set out in International Accounting Standard (IAS) 24: Related Party Disclosures.

These differences impact how related parties are identified and treated under each framework. Consequently, businesses operating in the UAE should conduct a thorough assessment based on UAE TP rules rather than relying solely on financial statement disclosures or global TP policies.

For a comprehensive understanding of the UAE’s transfer pricing regulations and disclosure requirements, refer to our detailed guide

- Kinship and Affiliation (natural persons[1])

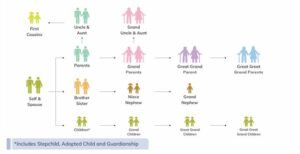

- Two or more individuals related to the fourth degree of kinship or affiliation, including by birth, marriage, adoption, or guardianship.

- Kinship*—each step from a common ancestor that describes the level of relationship between two blood-related persons, such as first cousins, one sibling to another, parent to child.

- Affiliation: the state of being closely associated with or connected to an organization

* Generally, a first degree, second degree, third degree, or fourth degree kinship or relative of the individual means

- First-degree relatives include an individual’s parents, siblings, and children

- Second-degree relatives include an individual’s grandparents, grandchildren, uncles, aunts, nephews, nieces, and half siblings

- Third-degree relatives include an individual’s great-grandparents, great-grandchildren, great-uncles/aunts, and first cousins

- Fourth-degree relatives include an individual’s great great-grandparents, great-great-grandchildren, and first cousins once removed (i.e., the children of the individual’s first cousins)

- Ownership / Control

- An individual and a legal entity where the individual, alone or with a related party, directly or indirectly owns or controls at least 50% of the entity.

- Two or more legal entities where one entity, alone or with a related party, directly or indirectly owns or controls at least 50% of the other.

- Two or more legal entities if a taxpayer alone, or with a related party, directly or indirectly owns a 50% share of each or controls them.

- Control

- Control means having the ability to influence another person or entity. This can be through:

- Voting Rights: holding 50% or more of the voting rights.

- Board of Directors: being able to determine 50% or more of the board’s composition.

- Profit Sharing: receiving 50% or more of the profits.

- Significant Influence: Exercising significant influence over the business and its affairs.

- Other Scenarios

- Includes relationships like a person and their Permanent Establishment, partners in the same unincorporated partnership, and connections through trusts or foundations.

Learn about the Country-by-Country Reporting requirements and how they relate to related party transactions.

IDENTIFICATION OF RELATED PARTIES UNDER UAE TRANSFER PRICING REGULATIONS

- Natural person [Article 35(1)(a)]

- Related within the fourth degree of kinship or affiliation, including relationships established through adoption or guardianship

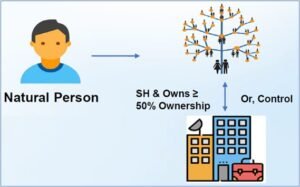

- Natural person and Juridical Person [Article 35(1)(b)]

- A Natural Person (NP) or at least one Related Party (RP) of the NP holds shares in a Juridical Person[2] (JP), and the NP, either individually or together with its RP, directly or indirectly owns 50% or more of the ownership interest in the JP.

- The NP, either alone or in combination with its RP, directly or indirectly controls the JP.

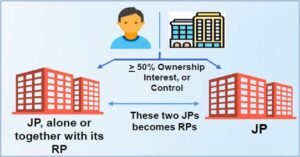

- Two or more juridical persons (legal entity) [Article 35(1)(c)]

-

- A Juridical Person (JP), either independently or in conjunction with its Related Party (RP), directly or indirectly holds 50% or more ownership interest in another Juridical Person (JP).

-

- A Juridical Person (JP), either independently or in conjunction with its Related Party (RP), directly or indirectly controls another Juridical Person (JP).

-

- Any Person, either independently or in conjunction with its Related Party (RP), directly or indirectly owns 50% or more ownership interest in, or controls, two or more Juridical Persons (JPs).

- A Person and its Permanent Establishment or Foreign Permanent Establishment [Article 35(1)(d)]

- Two or more Persons that are partners in the same Unincorporated Partnership. [Article 35(1)(e)]

- A Person who is the trustee, founder, settlor, or beneficiary of a trust or foundation and its Related Parties. [Article 35(1)(f)]

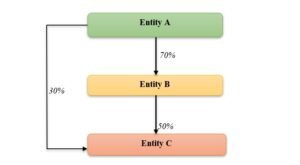

Example of Related Parties under UAE CT Law

*Ownership of a legal entity encompasses voting rights, a share in profits, and authority over the composition of the board.

-

- Entity A and Entity B are considered related entities due to Entity A holding a majority ownership share in Entity B.

- Similarly, Entity A and Entity C are related through a combination of direct and indirect ownership. Entity A holds an indirect ownership of 35% in Entity C via its 70% stake in Entity B (70% x 50%) and a direct ownership of 30%, resulting in a total ownership interest of 65%, which exceeds the 50% threshold.

- Furthermore, Entity B and Entity C are related as they are both affiliated with Entity A.

To understand how related party transactions fit within the broader corporate tax framework, consult our UAE Corporate Tax Guide.

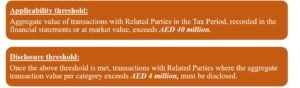

TP DISCLOSURE FORM AND RELATED PARTY SCHEDULE

The RPT Schedule (Schedule 16) is a part of the TP Disclosure Form, which forms the first section of the UAE Corporate Tax (CT) Return. It requires the disclosure of high-value transactions with related parties, as defined in Article 35 of the UAE CT Law, when prescribed thresholds are met. This schedule includes details such as party name, country, transaction type, gross value, TP method used, arm’s length value, and any tax adjustments. All transactions with related parties must be reported, covering categories like goods, services, intellectual property, interest, assets, liabilities, and others.

Stay informed about the reporting deadlines to ensure timely compliance with UAE transfer pricing regulations.

Disclosure requirements

- 1.5 | Gross Income/Expenses

This field requires the Gross Income Earned (Revenue before any Deductions), or Expenses Incurred in relation to the transaction with such Related Party. The UAE TP Disclosure Form requires reporting the full gross value of related party transactions before any adjustments. This means reporting the total transaction amounts without netting off or reducing by discounts or rebates.

- 1.6 | Transfer Pricing Method

The UAE TP Disclosure Form allows selection of six standard OECD transfer pricing methods: The Comparable uncontrolled price method (CUP), the resale price method (RPM), the cost-plus method (CPM), the transactional net margin method (TNMM), the transactional profit split method (PSM), and the other method.

Explore the various transfer pricing methods applicable in the UAE to make sure accurate and compliant reporting.

- 1.7 | Arm’s Length Value

This field requires the Arm’s Length Value of the Related Party Transaction (the value which would have been if such Party were not a Related Party).

- 1.8 | Tax Adjustment

This field is calculated automatically based on the difference between Gross Income/Expenses and Arm’s Length Value. This can be an upwards or downwards adjustment as mentioned below. The “Tax adjustment” field in the UAE TP disclosure form represents the difference between the actual transaction value and the arm’s length value. It’s the amount by which the taxable income would need to be adjusted to reflect arm’s length pricing. This field helps tax authorities understand the potential impact of transfer pricing on the entity’s tax liability.

For detailed information on the disclosure requirements for related party transactions, refer to our comprehensive guide on Transfer Pricing Disclosure Requirements.

KEY TAKEAWAYS

The definition and identification of related parties under the UAE CT Law are crucial for businesses to ensure compliance with the new regulations. Understanding the distinctions between related party criteria under UAE Transfer Pricing rules and international frameworks is essential to properly assess business relationships. Additionally, the requirement to maintain Arm’s Length Price (ALP) and submit a Transfer Pricing Disclosure Form (DF) ensures transparency, particularly when related party transactions exceed specified thresholds. By adhering to these regulations, businesses can navigate the evolving tax landscape, minimize risks, and contribute to the UAE’s broader fiscal objectives.

Avoid common pitfalls in tax compliance by reading our article on Common Tax Mistakes Businesses Make and How to Avoid Them.

HOW BCL GLOBIZ CAN HELP?

- Related Party Analysis: Assist in identifying related parties and connected persons under UAE-specific TP rules, ensuring compliance with Federal Decree-Law No. 47 of 2022 and TP Guidelines.

- Documentation Support: Help in preparing robust TP documentation aligned with OECD guidelines and UAE regulations to meet statutory requirements. Understand the componets of the Master File and its role in transfer pricing documentation.

- Compliance Assurance: Ensure your business adheres to UAE TP regulations, avoiding penalties and fostering smooth interactions with the Federal Tax Authority (FTA).

- Customized Solutions: Offer practical strategies to manage tax and TP risks, leveraging our expertise in UAE and international tax regimes.

- Ongoing Support: Provide continuous updates and advisory on regulatory changes and their implications for your operations.

[1] Natural Person: Individual human being (distinct from a juridical person).

Person: Any Natural Person or Juridical Person.

[2] The guide confirms that juridical person (also referred to as Free Zone (FZ) Person), i.e., incorporated, established, or otherwise registered in a FZ, including a branch of a Non-Resident Person or a UAE juridical person that is registered in a FZ.

Discover how proactive transfer pricing strategies can benefit your business beyond compliance.