Understanding UAE Transfer Pricing Regulations and Disclosure Requirements

FINAL CALL FOR TP DISCLOSURE COMPLIANCE

With the UAE Transfer Pricing (TP) Disclosure Form deadline approaching, businesses must prioritize compliance with tax regulations. As outlined in Article 55 of Federal Decree-Law No. 47 of 2022, Taxable Persons are required to submit a disclosure form alongside their Tax Return, providing details of transactions with Related Parties and Connected Persons.

To provide clarity, the Federal Tax Authority (FTA) has issued a Corporate Tax Return Guide, which defines the materiality thresholds for such reporting. With the first Corporate Tax Return deadline set for 31st December 2024, businesses should ensure they understand these requirements and prepare accurate filings to avoid penalties for non-compliance.

Key Schedules Introduced in the New FTA Tax Return Guide

The FTA has included the following two schedules in the new tax return guide:

- Schedule for Related Party Transactions

- Schedule for Connected Persons

Deadline for Filing the Disclosure Form

Taxpayers are required to submit the transfer pricing disclosure form along with their corporate tax return within 9 months after the conclusion of the relevant tax period.

Understanding Corporate Tax Return Deadlines for Newly Incorporated Companies

When it comes to corporate tax filing, the general deadline for submitting the return, along with key forms like

The filing deadline is within 9 months after the financial year ends, providing sufficient time for document preparation.

Companies incorporated after 1st June, 2023, with a financial year ending on 31st December, 2023, have a shortened deadline of six or seven months, requiring filing in 2024.

Corporate Tax Filing Deadlines for Regular Financial Year Companies

- Companies incorporated before 1st June, 2023, with a standard FY (January-December) must file their CT return within nine months after year-end.

- For most, the 2024 financial year ends on 31st December, with a CT return deadline of 30th September, 2025.

- Plan in advance to ensure all forms and documentation are ready before the deadline to avoid penalties.

With the immediate deadline effectively managed, we can now turn our attention to a detailed and systematic review of form comprehension.

To stay compliant with corporate tax regulations, consult our detailed UAE Corporate Tax Guide.

UAE CT Return – TP Disclosure Form

Let’s have a quick understanding as to who will be determined as a Related Party:

- The Family Tree Crew: Those tangled up in the branches of your family tree, from siblings to distant cousins, grandparents, great-grandparents, and even great-great-grandparents!!! and anyone else officially bound to you (adopted or otherwise).

- Individual & Company Control: A person (alone or with associates) owning at least half of a company or having significant influence over its operations.

- Connected Companies: Two or more companies where one has majority ownership, control, or both, or where a single entity has significant influence over multiple companies.

- Business Entity & Location: A company and its permanent place of business, regardless of location.

- Business Partners: Individuals involved in a business partnership that is not a legally separate entity.

- Trust/Foundation Affiliations: Individuals involved in a trust or foundation as trustees, founders, beneficiaries, or those connected to them.

Related Party Reporting:

- Taxable persons must report high-value transactions with related parties in the transfer pricing disclosure form.

- The threshold is 40 million AED, requiring reporting if total transactions exceed this amount in a financial/taxable year.

- Dividends between related parties are excluded from threshold calculations.

- Revenue and expenditure must be reported separately, including amounts and types of income/expenses for each related party.

The following are the contents in the disclosure form:

| Contents | Meaning |

| Name of the Related Party | Specify the legal name of the related party involved in the transaction. |

| Transaction type | The drop-down menu enables you to choose from various transaction types, including liabilities, assets, interest, intellectual property, services, goods, and more. |

| Related party tax residency details | The drop-down menu lets you select the country where the related party is a tax resident, including the option to choose the UAE. |

| TIN or TRN for RP | Enter the related party’s TIN from a foreign jurisdiction or TRN for UAE Corporate Tax. |

| Gross Income or expense value | The gross value of transaction is required to be filled, not the net value in AED |

| TP Method | TNMM, CUP, PSM, CPM, RPM and other method (Added recently) |

| Arm’s Length Value | Shall be determined from the benchmarking conducted during the Tax Period |

| Tax Adjustment | Difference of income/expense & ALP value |

Connected Persons Payments/Benefits Reporting

- Taxable persons must disclose high-value transactions with connected persons in the TP disclosure form.

- The threshold is 500,000 AED, requiring disclosure if total transactions exceed this amount in a single year.

The requirement applies only when benefits or income per connected person (including related parties) exceed the 500,000 AED threshold.

The following are the contents in the Disclosure Form:

| Contents | Meaning |

| Name of the Connected Persons | Specify the legal name of the related party involved in the transaction. |

| TIN or TRN | Provide the TIN or TRN of the connected person if available. |

| Benefit or Payment | The drop-down list will allow you to select this. |

| Description | Provide details of payments made to the connected person and services received from them |

| Amount of Benefit or Payment | Enter the amount of each payment made to connected persons during the taxable year |

| Market Value of Benefit or Service Provided | Treat it as a payment to a non-connected person and specify the corresponding amount. |

| Tax Adjustment | The portal will calculate it automatically. |

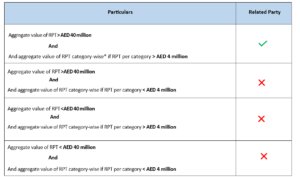

Summary of Related Party (RP) Disclosure Form Applicability

* Category-wise: The relevant category should be selected from the drop-down list, which offers the following options:

- Goods

- Services

- Intellectual Property

- Interest

- Assets

- Liabilities

- Others

Summary of Connected Persons (CP) Disclosure Form Applicability

How to be ready for the TP Disclosure Form?

Why BCL for your TP Documentation?

BCL Globiz, a firm of Chartered Accountant in Dubai, endeavors to provide high-quality services in the areas of business incorporations, accounting, payroll, compliance management, transfer pricing, corporate & start-up advisory, and virtual CFO services.

For a broader perspective on transfer pricing, read our blog on Transfer Pricing: The End Is the New Beginning.

BCL Helps your Business with Expert Tax Guidance and FTA Representation in the UAE

At BCL Globiz, our expert team ensures precise transfer pricing documentation and compliance with evolving regulations. We assist with strategic planning, stay updated on tax developments, and help you navigate complex policies. Contact us for tailored advice on transfer pricing and corporate tax matters to ensure seamless compliance. Please reach out to us at rakesh@bclglobiz.com.

Interested customer can refer this link for Transfer Pricing Services in Dubai, UAE

Also read our most searched articles on

- Selecting the appropriate transfer pricing method is vital for compliance. Explore the different methodologies in our comprehensive guide on Transfer Pricing Methods in the UAE.

- Country-by-Country Reporting is a key component of transfer pricing compliance. Understand its significance and requirements in our article on Country-by-Country Reporting UAE Requirements.

- Multinational enterprises must adhere to Master File requirements. Learn more about these obligations in our guide on Master File Transfer Pricing Requirements.

- Understanding the scope of related party transactions is crucial. Dive deeper into the definitions and implications in our article on Related Parties in UAE Transfer Pricing.

- For comprehensive insights into the UAE Transfer Pricing Disclosure Form, including submission procedures and compliance nuances, refer to our detailed guide on UAE Transfer Pricing Regulations and Disclosure Form.