The UAE has been advancing its digital transformation journey, especially in relation to legal and taxation regulations. VAT was introduced in 2018 and Corporate tax in 2023. The next major step in streamlining the tax and regulatory compliance is “e-invoicing.” The majority of the countries are implementing an e-invoicing system to regulate the method of invoice generation, and the UAE has also followed the same footsteps.

In this blog, we try to learn and decode e-invoicing, equipping our readers with the knowledge to be compliant well before its implementation.

What is e-invoicing?

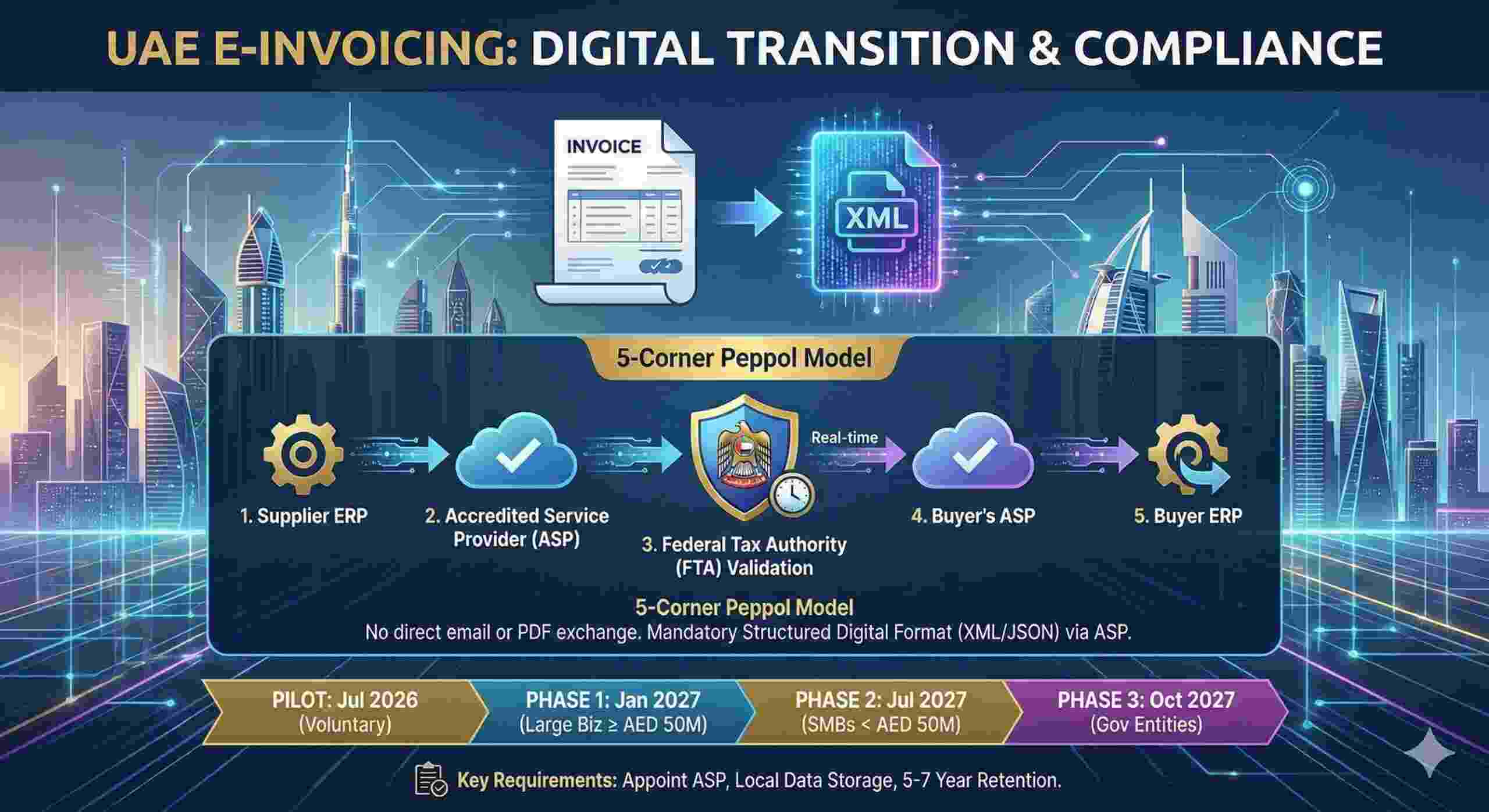

The Ministry of Finance defines it as a structured form of invoice data that is issued and exchanged electronically between a supplier and a buyer and reported electronically to the UAE Federal Tax Authority. It is important to note that unstructured invoice formats such as PDF, Word documents, images, scanned copies, and emails are not e-invoices.

Businesses already following VAT rules should also understand how to raise a VAT-compliant invoice in the UAE, as e-invoicing will further standardize invoice formats and reporting requirements.

When will e-invoicing in Dubai be implemented?

Articles 3, 4 and 5 of the Ministerial Decision No. 244 of 2025 on the Implementation of the Electronic Invoicing System show-

- Pilot program: The ministry shall notify a person to include in the Taxpayer Working Group. Such a person shall be included in such a group and shall comply with all technical requirements established. This pilot program shall commence on 1st July 2026.

- Voluntary implementation: If any person on a voluntary basis implements from 1st July 2026 and complies with all technical requirements.

- Large business: Any person whose revenue is equal to or more than AED 50,000,000 shall appoint an Accredited Service Provider (ASP) by 31st July 2026 and implement an e-invoicing system by 1st January 2027.

- Smaller business: Any person whose revenue is less than AED 50,000,000 shall appoint an Accredited Service Provider (ASP) by 31st March 2027 and implement an e-invoicing system by 1st July 2027.

- A government entity shall appoint an accredited service provider by 31st March 2027 and implement e-invoicing from 1st October 2027.

What is not covered in e-invoicing?

- Business transactions conducted by government entities in their sovereign capacity.

- International passenger transportation services provided by an airline via an aircraft, where an electronic ticket is issued to the passengers.

- Any ancillary services related to the previous point where an electronic miscellaneous document is issued.

- International transportation services in respect of goods, provided by an airline, where an airway bill is issued for such services for a period of 24 months from the date of e-invoicing becoming effective.

- Financial services that are exempt from VAT or subject to VAT at the zero rate, in accordance with Article 42 of the VAT Executive Regulation.

- Currently, the business-to-consumer transactions are not covered in the e-invoicing system. Any companies engaged in B2C transactions need not comply with e-invoicing for such transactions until determined by a decision issued by the minister.

Who is an Accredited Service Provider (ASP)?

An ASP is a service provider entity that has received official accreditation by the UAE Ministry of Finance (MoF) to participate in the e-invoicing ecosystem. Basically, the business must use ASP to validate, transmit, exchange, and report the e-invoice data.

An Accredited Service Provider (ASP) is not just a vendor—it is the technical gateway between your business and the UAE e-invoicing network.

What does an Accredited Service Provider (ASP) do?

- Validates the e-invoice submitted by the supplier to check the mandated format and data requirements.

- Converts the invoice into a structured digital format via the OpenPeppol/Peppol-based standard.

- Transmits e-invoice to the buyer’s ASP.

- Reports tax-relevant data from e-invoice to the FTA.

- Ensures ongoing compliance with security, technical, and regulatory standards.

What is expected of UAE e-invoicing?

- Standardization of invoice formats such as XML / PDF with embedded structured data

- Unique invoice identification numbers

- Real-time reporting to the tax system

- Authentication and validation through a secured platform

- Storage of invoices in electronic formats for statutory purposes

How should the businesses prepare for e-invoicing now in the UAE?

- Assess the current invoicing flow

- Upgrade the accounting/ERP systems

- Invest in reliable e-invoicing tools

- Train finance and compliance teams

- Strengthen document retention controls

To comply effectively, businesses should evaluate and upgrade their systems using FTA-approved accounting software solutions in Dubai that can integrate with the UAE e-invoicing framework.

What are the benefits of e-invoicing for businesses in the UAE?

- Faster invoicing

- Reduced manual work

- Real-time visibility

- Standardization

E-invoicing marks a big leap in the digital transformation. Businesses that adopt early will stay compliant and gain a competitive advantage through automation and improved financial control.

We, at BCL Globiz, understand that the business must focus on the core activities. We offer one-roof solutions to businesses on accounting, VAT, corporate tax, transfer pricing, and payroll, enabling the business to harvest the maximum benefit of outsourcing critical functions.

Our team of experts helps and guides you to obtain all necessary registrations and certificates, file returns, and get the latest updates about e-invoicing to stay compliant and to stay ahead of the competition.

For further information, reach out to our experts at punith@bcl.ae.