January 28, 2025

Taxation

Top Exemptions in UAE Corporate Tax: What You Need to Know The UAE’s corporate tax law, implemented in June 2023, imposes a 9% corporate tax

The Corporate Tax framework gave a clear message to the businesses that compliance is non-negotiable. However, with any new tax regimes, there are bound to be transitional delays. To ease …..

The Corporate Tax framework gave a clear message to the businesses that compliance is non-negotiable. However, with any new tax regimes, there are bound to be transitional delays. To ease …..

As the UAE transitions into a formal corporate tax regime under Federal Decree-Law No. 47 of 2022, the approach to related party (RP)/payments to connected persons (CP) transactions has become …..

As the UAE transitions into a formal corporate tax regime under Federal Decree-Law No. 47 of 2022, the approach to related party (RP)/payments to connected persons (CP) transactions has become …..

Mashreq Bank, one of the oldest and most trusted financial institutions in the region, has designed a range of business accounts that cater to freelancers, startups, SMEs, and large corporates …..

Mashreq Bank, one of the oldest and most trusted financial institutions in the region, has designed a range of business accounts that cater to freelancers, startups, SMEs, and large corporates …..

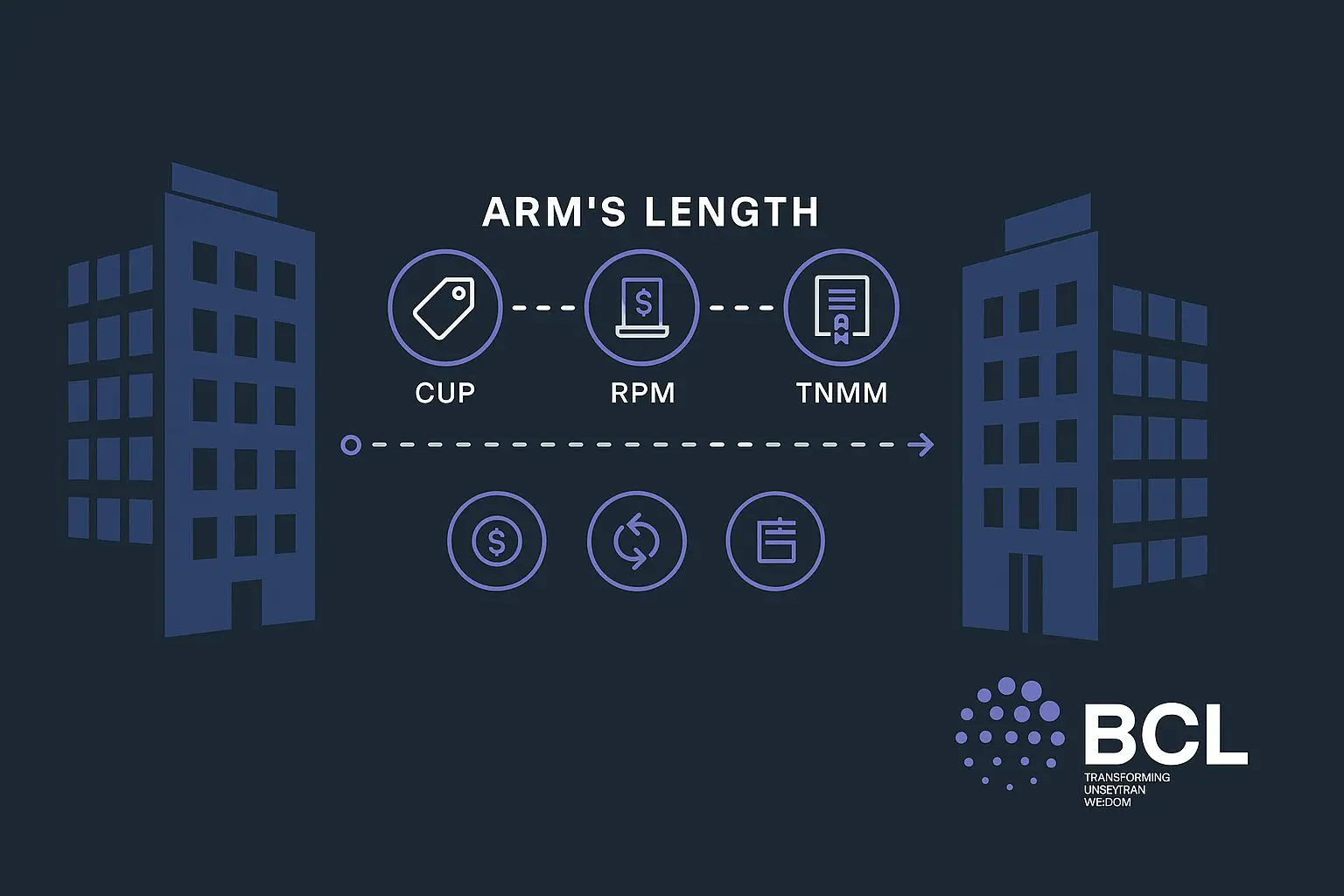

Overview A cornerstone of the UAE CT Law, Article 34, relies on the Arm’s Length Principle (ALP), a fundamental concept in Transfer Pricing (TP). It ensures that transactions between Related …..

Overview A cornerstone of the UAE CT Law, Article 34, relies on the Arm’s Length Principle (ALP), a fundamental concept in Transfer Pricing (TP). It ensures that transactions between Related …..

Wio Bank P.J.S.C. is a digital neobank that offers a banking app, financial integration, and banking as a service solution. These are designed to cater to individuals and businesses to …..

Wio Bank P.J.S.C. is a digital neobank that offers a banking app, financial integration, and banking as a service solution. These are designed to cater to individuals and businesses to …..

Recently, many companies registered in UAE Free Zones have been receiving emails from their respective Free Zone authorities regarding Anti-Money Laundering (AML) and Combatting the Financing of Terrorism (CFT) compliance. …..

Recently, many companies registered in UAE Free Zones have been receiving emails from their respective Free Zone authorities regarding Anti-Money Laundering (AML) and Combatting the Financing of Terrorism (CFT) compliance. …..

Need Help?

We're Here To Assist You

Something isn’t Clear?

Feel free to contact us, and we will be more than happy to answer all of your questions.