The banking landscape has undergone a significant transformation in recent years, thanks to the rise of digital banks. These financial institutions provide their customers with a convenient and efficient way of managing their finances exclusively online. In the United Arab Emirates (UAE), the digital banking sector has been growing rapidly, providing residents with innovative banking solutions.

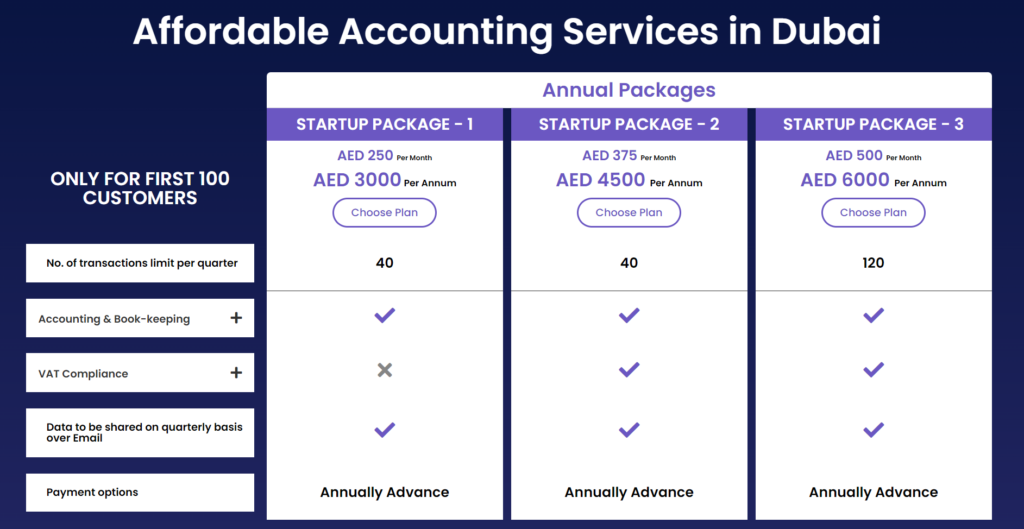

Grab this Month’s Exclusive Offer on Accounting, Bookkeeping & Tax Services !

In this blog, we’ll explore the list of Digital Banks in the UAE that you need to keep an eye on;

-

Liv Account

Liv. by Emirates NBD, launched in 2017, is a trailblazer in the digital banking space in the UAE. Liv. account has gained popularity for its user-friendly mobile app and its ability to cater to the lifestyle of young and tech-savvy individuals. It creates a personalized mobile experience that puts banking and daily purchases in one place. offers a user-friendly mobile app that empowers users with personalized financial insights, budgeting tools, and customizable debit cards. They provide competitive 2% return on account balances greater than 5000 AED. One can send up to AED 150,000 per day, and AED 500,000 per month to any UAE account and receive unlimited money into the Liv account. With its zero-balance requirement, it’s accessible to all, including students and young professionals. Liv. encourages financial responsibility through expense tracking, savings goals, and smart shopper rewards.

-

YAP

The YAP, launched in 2019, is a neo bank that focuses its efforts on improving the experience of digital banking. It functions as an independent app with no physical branches. YAP products are issued by the National Bank of Ras Al Khaimah (P.S.C) ‘RAKBANK’ pursuant to the license by Mastercard Asia/Pacific Pte. Ltd. It provides spending and budget analytics, Peer to peer payment and remittance services, and bill payment. The maximum amount that can be transferred at one time is AED 10,000. One can do multiple transfers throughout the day.

-

Mashreq Neo

Mashreq Neo is a digital banking platform offered by Mashreq Bank. It was launched in 2017 and based in Dubai. Mashreq Neo was designed to provide a modern and convenient banking experience to the users. This digital banking app can be easily downloaded from App Store or Play store and the account can be opened. This digital bank offers a variety of services such as Personal and Business Accounts, Savings Accounts, Neo NXT, 1.1% interest with MaxSaver, AED 500 welcome bonus, AED 350 Cashback, Visa Debit Cards and Optical Character Recognition (OCR).

-

ADIB Smartbanking

ADIB Smartbanking was launched in 2019 by Abu Dhabi Islamic Bank. Smartbanking combines digital onboarding with a variety of innovative products offered via a dedicated mobile banking application and a user-friendly online banking platform. One need not visit a branch to open the Smartbanking account, and can book the delivery of the Welcome Pack and Debit Card at the time and location of one’s choice. One can deposit funds directly into the accounts or complete any routine transactions such as transfers and bill payments at no additional charge.

-

ADIB Amwali

Amwali a digital banking app for young people launched by ADIB. It allows parents to open a digital bank account without the need for a signature. Parents can have complete control over their Amwali account including monitoring their daily spending, withdrawals etc. It provides children with an understanding of banking transactions such as payments, purchases, saving and much more, while allowing parents full control over the account.

-

Xpence

Xpence is the next generation smart business expense management platform with integrated physical and virtual Visa cards for freelancers, startups, SMEs and large corporates. Xpence gives businesses the tools they need to manage their spending. With Xpence employers can issue physical and digital prepaid Visa cards immediately to their employees. They can establish spending limits and policies for each card, and keep track of all company expenditure in real time. Every time an employee makes a purchase using their card, Xpence automatically reminds them to capture the purchase receipt with a push notification. With the help of Xpence companies can no longer waste time on expense reports.

-

WIO

WIO is an all-in-one digital financial platform created to reboot banking for everyone. It is a government backed digital bank, launched in 2022. The bank’s business lines include digital banking, embedded finance and Banking-as-a-Service (BaaS). The bank focuses on serving small- to medium-sized businesses (SMBs). It also offers digital cards and free debit cards. Fast and digital account opening, zero hidden charges, No minimum balance, AED and USD accounts and Smart payments solutions are some of the features of the WIO account.

-

OG Pay

OG Pay is one of UAE’s best digital banking solutions. It’s one of the safest and most affordable digital banks in the UAE. It’s easy to register for OG Pay online or through its official app. After registering, one would receive a digital debit card that can be used right away. One can also purchase and sell a variety of cryptocurrencies through this digital platform. With this feature, anyone can start building a portfolio of digital assets, no matter how small or large they are. The account balance with OG Pay will also earn you an interest rate of 2% annually.

-

Zand

Zand is a digital bank licensed by Central Bank of UAE. It aims to provide a comprehensive range of banking and financial services, catering to both retail and corporate customers. The platform offers advanced digital banking solutions and financial products. It offers accounts, cards, loans, and financial management tools to its clients.

How difficult it is to open a bank account in UAE?

Opening a bank account in the UAE can vary in difficulty depending on factors such as one’s residential status and the bank’s specific requirements. For residents with valid visas, it is relatively straightforward, typically requiring proof of identity, residency, and a minimum deposit. Non-residents may encounter more stringent criteria and fees. Corporate accounts can be more complex, necessitating extensive documentation and compliance with regulatory standards.

Bank with ease with the Neo Banks

Why depend on the traditional banking system, when there are Neo banks in the UAE. Neo banks have revolutionized the account opening process in the UAE by leveraging digital technology and innovative approaches, making it significantly easier and more convenient for individuals and businesses with its features such as Online-First approach, minimal documentation, speedy processing, user-friendly apps and accessibility round the clock.

Final Calculation:

The UAE’s digital banking sector is evolving rapidly, offering a variety of innovative solutions to cater to different customer needs. Remember to conduct thorough research and consider your specific financial goals and preferences when choosing the digital bank that’s right for you.

At BCL Globiz we provide accounting and bookkeeping service and can help you with the opening of the digital bank account in UAE.

Feel free to reach out to us on BCL Contact Us.

UAE

UAE UAE

UAE INDIA

INDIA UK

UK